The Comprehensive Guide To FP&A (And Why FMCG Businesses Need It)

Financial Planning & Analysis (FP&A) functions play a crucial role in helping FMCG brands to improve financial performance, strategic decision-making, and overall efficiency.

In this guide, we’ll run through some of the most important ways in which FMCG brands can benefit from skilled FP&A hires.

What are the primary functions of FP&A for FMCG businesses?

Budgeting & Forecasting

FP&A teams can help FMCG brands to develop accurate, data-fuelled budgets and forecasts. By analysing historical data, market trends, and other relevant factors, FP&A professionals deliver insights that enable businesses to set realistic financial targets - and lay the groundwork for future growth.

Performance Analysis

FP&A experts will conduct regular performance analyses to evaluate how an FMCG brand is performing against its financial goals and business KPIs (Key Performance Indicators.) This type of analysis is absolutely vital for long-term growth, as it allows companies to establish their strongest products, identify areas for improvement, and optimise their operations.

Pricing Strategies

Developing effective pricing strategies is crucial for FMCG brands looking to stay competitive, and FP&A teams can be invaluable here. By conducting pricing analyses, reviewing cost structures, and evaluating competitive dynamics, FP&A professionals can help FMCG businesses to optimise their pricing and maximise profitability.

Profitability Analysis

FP&A teams can conduct an in-depth profitability analysis at various levels of an FMCG business, evaluating product lines, customer segments, and distribution channels. This type of analysis enables FMCG brands to understand which products or services are most profitable - and which may need to be optimised, adjusted, or removed.

Sales & Revenue Analysis

The more FMCG brands know about their sales and revenue, the better equipped they’ll be to drive growth. FP&A teams play a key role here, analysing financial data to identify sales trends, seasonality patterns, and external factors that may impact revenue. These insights help FMCG businesses to optimise their sales strategies and forecast more accurately.

Working Capital Management

FMCG brands often find themselves dealing with complex supply chains and inventory management challenges. FP&A professionals can offer a helping hand here, optimising working capital by monitoring inventory turnover, accounts receivable, and accounts payable to ensure efficient cash flow management.

Investment Decisions

FMCG brands will inevitably need to invest money in order to scale up - but making smart investments can be difficult. Fortunately, FP&A experts can perform data-driven financial modelling and scenario analyses to help brands understand the potential risks/rewards of product launches, expansions, or acquisitions.

Cost Control & Expense Management

FP&A functions play a vital role in helping FMCG brands to monitor costs and identify areas where expenses can be controlled - without compromising product quality or customer satisfaction. This is hugely important for long-term profitability and business growth, particularly as FMCG companies scale up their operations.

Variance Analysis

FP&A teams can conduct variance analysis to compare a business’s actual financial performance with budgeted or forecasted figures. This allows FMCG brands to understand where they may be underperforming or overperforming, as well as providing businesses with the insights they need to make adjustments.

Data-Driven Decision Making

Above all else, FP&A professionals deliver the data-backed insights that businesses need to make better decisions. When FMCG brands are equipped with accurate data and financial expertise, they can improve decision-making across all areas of their businesses, from operations to marketing and sales.

To maximise the value of FP&A functions, FMCG brands should ensure that their teams have the ability to:

• Access accurate and timely data

• Utilise appropriate financial software/systems

• Collaborate closely with other departments

If FP&A professionals can leverage all of the resources they need, they can make a colossal difference to the efficiency, profitability, and competitiveness of FMCG businesses.

Which FP&A systems should FMCG businesses use?

Providing your FP&A function with the right financial software is hugely important. Without an effective system in place, FP&A professionals will struggle to deliver maximum value.

When selecting an FP&A system for your startup, you’ll need to consider various factors such as:

• Budget

• Business requirements

• Integration capabilities (with existing software)

• Scalability

• Ease of use

FMCG businesses should also keep an eye out for any significant updates or new entrants in the industry, as the software market moves quickly. When you’re looking to implement a new system, always be sure to read reviews, consult with other business owners, and take advantage of free trials wherever possible.

Below are some of the most common FP&A platforms for FMCG businesses:

Excel

While Excel isn’t a dedicated FP&A system, it’s still incredibly popular among start-ups due to its familiarity and accessibility. Excel can perform many basic tasks when it comes to data analysis and rudimentary financial modelling, but most FMCG brands will need to transition to more advanced systems as they grow.

Planful (formerly Host Analytics)

Planful is a cloud-based FP&A platform that offers budgeting, forecasting, and reporting capabilities. The system is well-suited to FMCG startups, as it allows them to streamline their financial processes and adapt to changing business needs.

Adaptive Insights (now part of Workday)

Adaptive Insights provides comprehensive FP&A functionalities with accessible interfaces, making it a great option for FMCG startups lacking financial expertise or experience with advanced systems.

Anaplan

Anaplan is a cloud-based planning and performance management platform that can scale up alongside a startup’s growth. The system allows for easy collaboration, as well as the integration of various financial and operational data sets.

Pulse (now part of Zoho)

Pulse is a budgeting and financial planning tool that integrates with Zoho’s suite of business applications. The platform is designed to be user-friendly and affordable for small and growing FMCG businesses.

Jirav

Jirav offers financial planning, reporting, and analytics tools for startups and small-to-medium-sized businesses. The software is known for its ease of use and simple integration with various accounting systems.

Float

While the Float tool focuses more on cash flow management, the platform can still be valuable for FMCG startups looking to plan and analyse their cash flow - an essential aspect of financial planning.

Fathom

Fathom provides FMCG startups with essential tools for financial analysis, management reporting, and business intelligence. It’s often favoured for its simplicity, accessibility, and clear visualisations - something that can be hugely beneficial for smaller companies.

ScaleFactor

ScaleFactor is an AI-powered financial platform that assists FMCG businesses with bookkeeping, accounting, and financial planning.

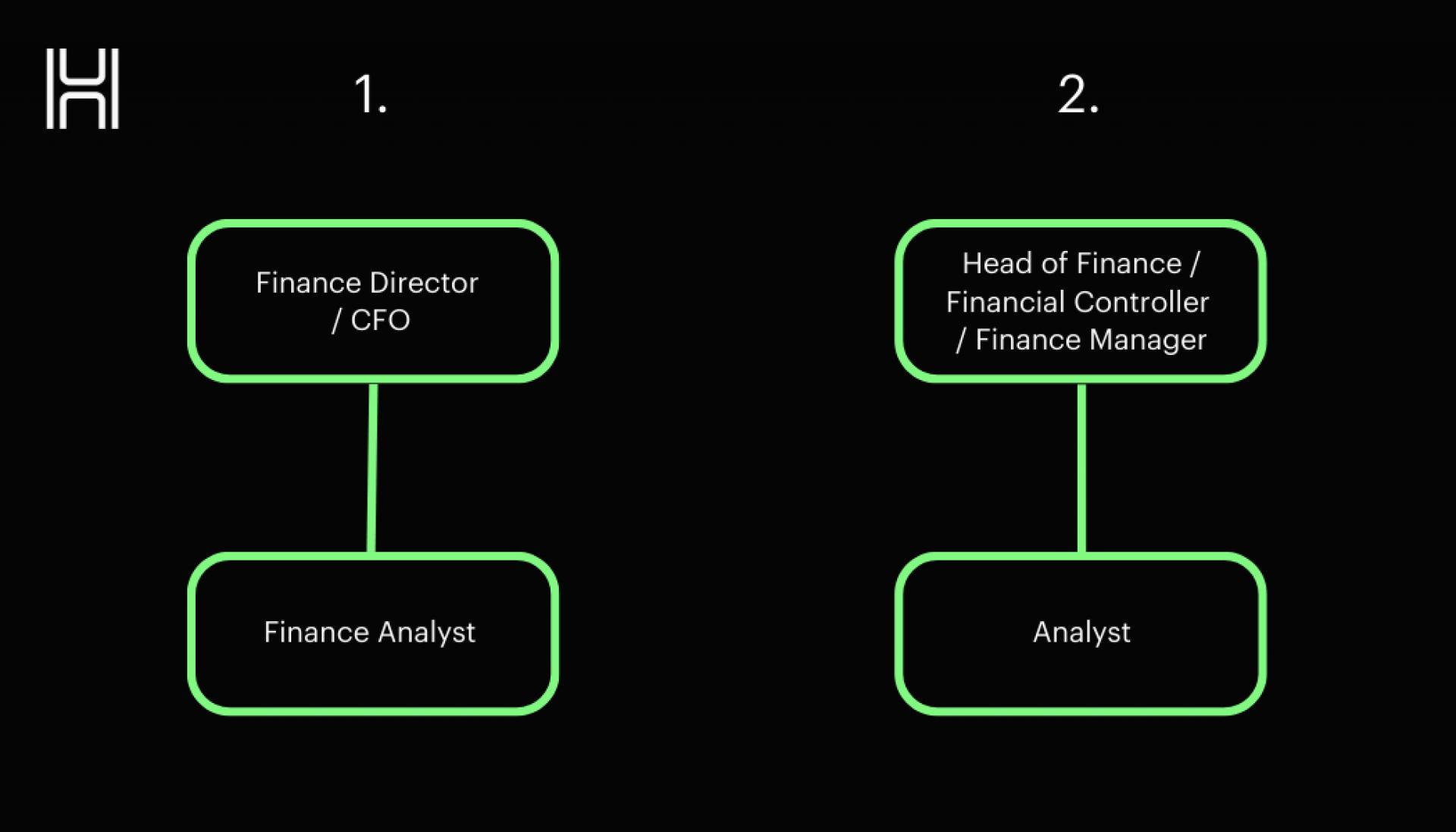

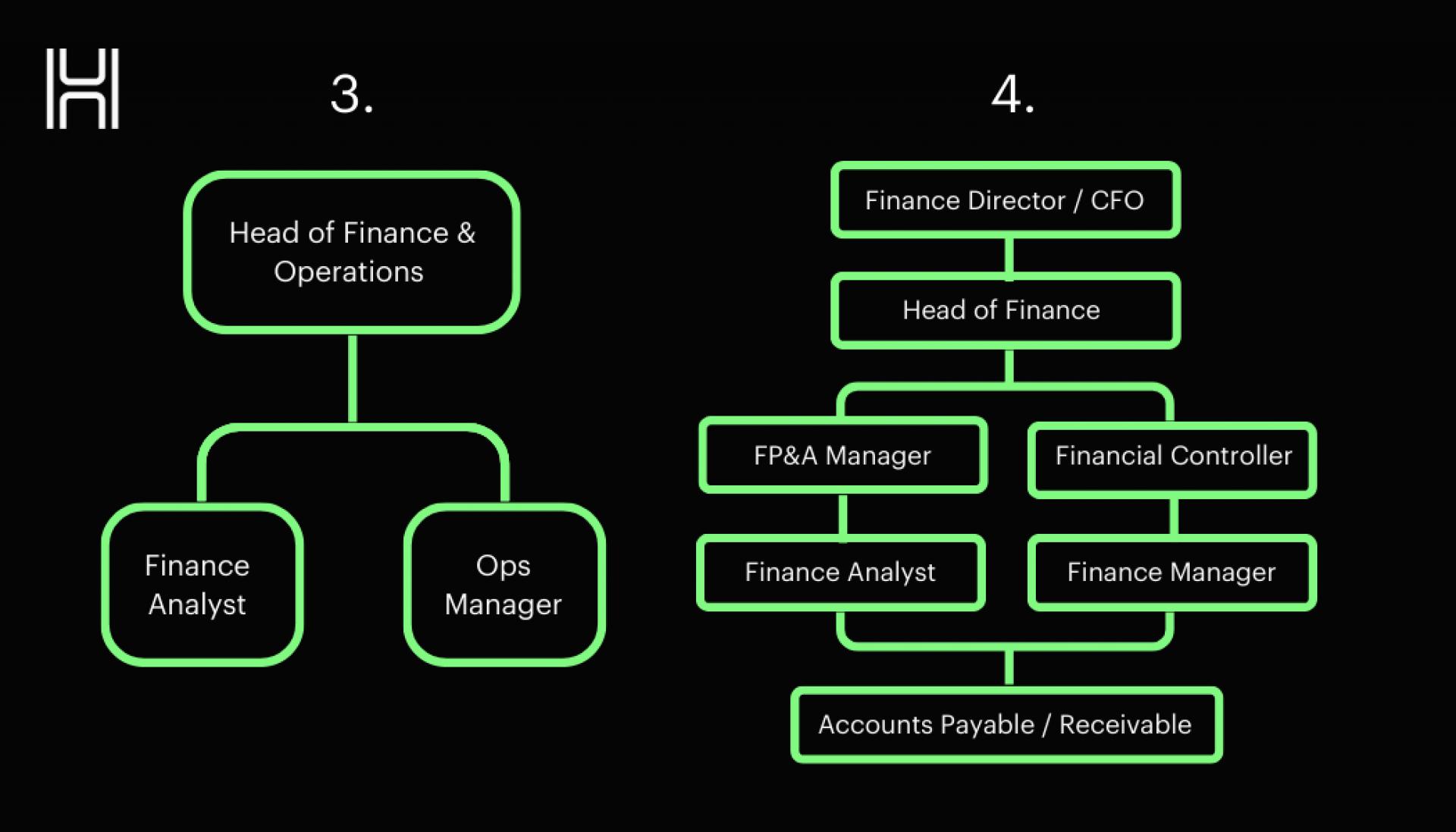

Typical Team Structures

This varies with size of business however here are some examples of different ways to structure FP&A:

1. Finance Director / CFO

Finance Analyst (working alongside outsourced function)

2. Head of Finance / Finance Controller / Finance Manager

Finance Analyst

3. Head of Finance & Operations

` Finance Analyst + Operations Manager

4. FD/CFO

Head of Finance

FP&A Manager + Finance Controller

Finance Analyst + Finance Manager

Transactional finance team

For more details on FP&A and how to hire FP&A teams into your business or generally any further information on the above please don’t hesitate to get in contact with [email protected]