Which SaaS metrics should you be measuring and Why? Our resident SaaS expert @Chris Short shares his thoughts

Many of us often associate financial technology with products like mobile payments and cryptocurrency platforms. But the world of financial technology is rapidly evolving.

How Financial Technology Is Helping Us To Live More Sustainably

Many of us often associate financial technology with products like mobile payments and cryptocurrency platforms.

But the world of financial technology is rapidly evolving.

Financial technology can be used to generate revenue and drive profits, but in the right hands, it also has the potential to make a huge impact on consumer behaviours.

Many Fintechs are now placing social purpose at the heart of their offering and developing tech solutions that are designed to facilitate sustainable living. These progressive brands are making it easier than ever for users to reduce their environmental impact, because Fintech products can seamlessly become a part of their daily routine.

Having recently secured B Corp certification ourselves, we’ve pulled together a handful of Fintechs who are helping consumers to live more sustainably, support the environment, and protect the planet.

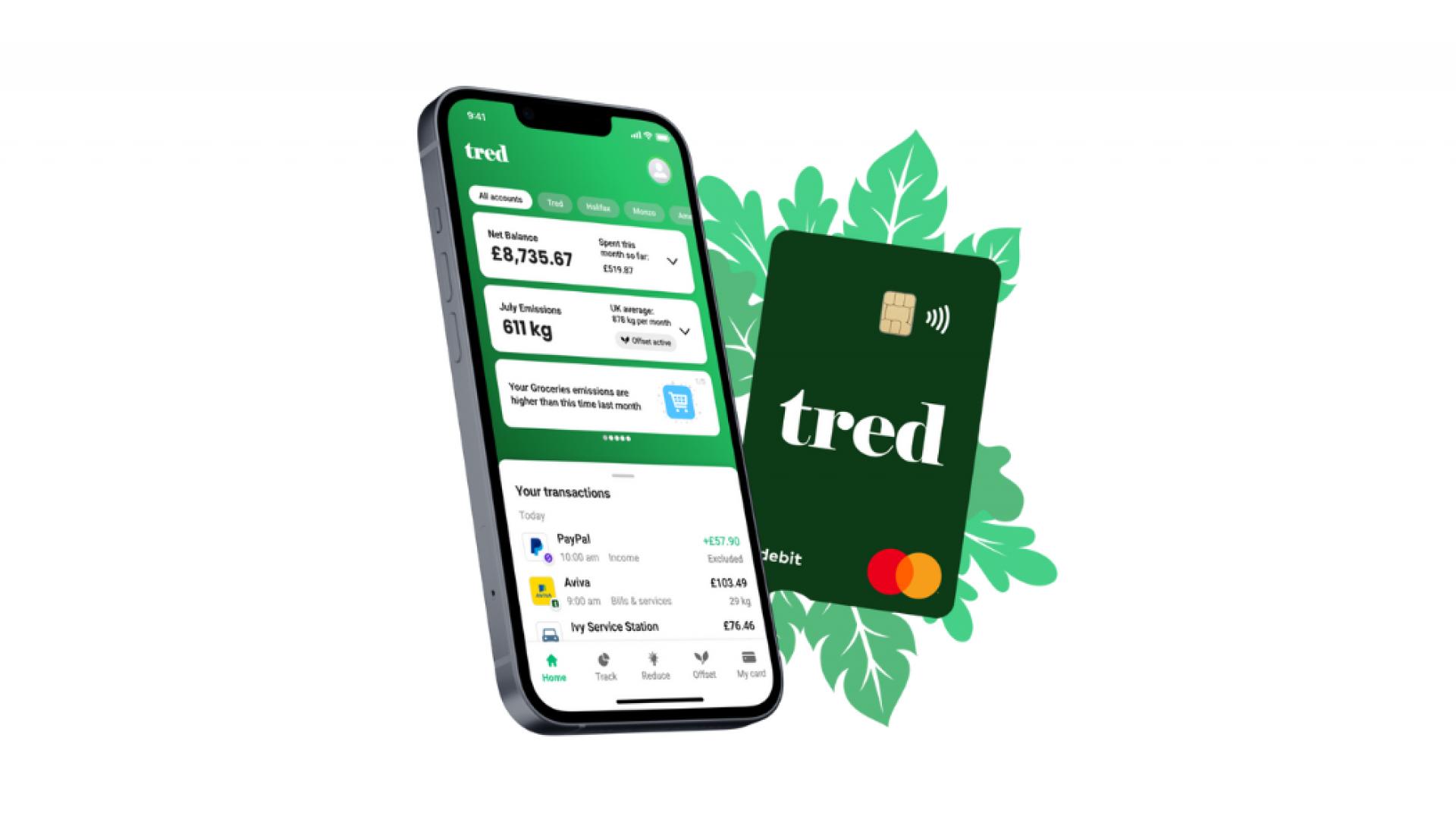

Tred

The Tred card is no ordinary debit card.

Whenever consumers pay with the Tred card, they automatically raise money for global reforestation projects. There’s no need for any drastic changes to the daily routine - Tred just makes every transaction work harder for the planet.

But Tred isn’t exclusively about raising funds to plant trees.

The app also helps users to live more sustainably and recognise their carbon footprint.

Customers can easily track their impact on the environment through spending insights. Tred calculates the carbon emission of every payment, providing users with accurate and personalised data about their transactions.

Tred then helps card owners to reduce and offset their carbon footprint. The app provides users with personalised tips, reward incentives, and the ability to contribute to carbon offsetting projects around the world.

The huge potential for this kind of Fintech is clear - Tred recently smashed a £600,000 crowdfunding target within 10 minutes of going live on Crowdcube.

The platform offers users a brilliant opportunity to monitor (and reduce) the environmental impact of their daily spending - all from a single debit card. Plus, even the card itself is made from recycled plastic, and it doesn’t get much greener than that.

Twig

Twig defines its product as ‘next generation banking’, helping users to both manage their finances and contribute to an eco-friendly circular economy.

The Twig offering has two core elements.

The first is the ‘Instant Cash Out’ feature that enables customers to easily sell (rather than throw away) items and clothing they no longer use. The process is convenient and fast - users upload their unwanted items, receive an instant valuation, and cash out with a swipe.

The second element is banking, which allows users to make purchases with the Twig debit card and control their finances through the Twig app.

Every aspect of the platform is about sustainable living. According to Twig, by extending the life cycle of clothes for just nine months, customers can reduce ‘carbon, water and waste footprints by approximately 20-30% each.’

The Twig Carbon Offsetting Subscription also encourages consumers to actively offset their carbon footprint.

This is another great example of a system that allows users to reduce carbon emissions conveniently and removes any obstacles that prevent sustainable living. The app is also growing fast, having recently raised £26m to fund product development and expansion.

Twig is all about driving positive behavioural changes through accessible tech. And in the words of the company itself, “Twig believes that sustainability and capitalism can coexist.”

Clim8

Clim8 is striving to prove that investors can balance achieving their financial goals with actively combatting the climate emergency.

Customers can access several different financial products with Clim8, including a Stocks & Shares ISA and a General Investment account.

Users can then put their funds and savings into ‘green investment’ options. Investors can choose from a range of publicly listed companies that are all working towards protecting the planet - from green energy innovators to circular economy brands.

Clim8 makes green investing simple and easily available to a wider audience, enabling users to tackle both financial and environmental goals with their money.

The product has generated a huge amount of market interest and quickly positioned itself as one of the leading ‘ethical investment’ platforms. In 2021 Clim8 raised $8m from various tech investors, and has even brokered a ‘media-for-equity’ deal with Channel 4 that’s guaranteed to increase exposure.

As with many eco-friendly Fintechs, one of the biggest strengths of Clim8 is its accessibility.

Investors don’t need to sacrifice potential earnings to help the planet, which is hugely important for attracting new customers and encouraging sustainable living.

Clim8 summarises its offering this way:

“Investing can do more to fight climate change than anything. If enough of us use it to hack the economic system, we can fast-track the future we want – for ourselves, our loved ones and the world. Done right, it’s the ultimate win-win for everyone.”

Treecard

Treecard allows users to live more sustainably with a brilliantly simple product.

When customers spend money with the fully-recyclable wooden Treecard, the company receives a small transactional fee from the store. Every time $50 is spent, a new tree is planted.

It’s as simple as that.

There’s no inconvenience for customers. All they need to do is spend money as they normally would, and their transactions will be used to protect and regenerate natural spaces in over 35 countries.

The card also offers all of the money management tools and features that you’d expect from a modern debit card.

Treecard has picked up serious momentum recently, as more and more investors recognise the potential of eco-friendly Fintech. In 2021 the business secured $5.1m of funding from several major investors, which will be used to develop the product and support sustainable causes around the world.

In many ways, Treecard is the perfect embodiment of progressive financial technology.

A simple but effective product that makes a big impact on the planet, without asking for big changes from consumers.

Novus

Novus is a highly innovative neobank (i.e. a digital challenger bank) that transforms everyday customer spending into positive global change.

Whenever users make a payment with the Novus card, they earn ‘impact coins’ that can be used to support several eco-friendly causes around the world. Novus is connected to over 10 of these sustainable projects, ranging from reforestation to ocean conservation.

The platform has already achieved incredible things. Through the impact coin system, the Novus community has supplied 25,386 days worth of clean water, protected 4,842 endangered sea turtles, offset 104,503 kgs of carbon emissions, and more.

Beyond earning and allocating impact coins, Novus customers can also accurately track their environmental impact.

Users can measure the carbon emissions of their transactions, contribute directly to environmental projects, and identify ethical brands to shop with.

Novus secured $5m of investment before launching to the public, and the platform is in a strong position to drive business growth and continue making meaningful changes to the planet.

The B-Corp certification

Many of these eco-friendly Fintechs are also B-Corp certified, which is a huge milestone for sustainable brands.

The B-Corp initiative acknowledges companies who are striving to create inclusive workplaces, support local communities, and protect the environment.

At Harmonic we’re incredibly proud to have recently achieved B Corp status. We can’t wait to continue working alongside other B Corp certified businesses and progressive clients who are making a real difference in the world.

Financial Technology has the power to do more than generate profits and optimise investments. Many Fintechs are proving that financial solutions can work in harmony alongside sustainable living, which is a vital step in the right direction for the future of the planet.

When we work in harmony, great things happen. Let’s show you how.

Get the latest insights, tips, and opportunities straight to your inbox – sign up today!