Which SaaS metrics should you be measuring and Why? Our resident SaaS expert @Chris Short shares his thoughts

In the fast-paced world of Software as a Service (SaaS) start-ups, where innovation and adaptability reign supreme, building and maintaining a successful venture requires a delicate balance of vision, strategy, and prudent financial management.

In the fast-paced world of Software as a Service (SaaS) start-ups, where innovation and adaptability reign supreme, building and maintaining a successful venture requires a delicate balance of vision, strategy, and prudent financial management. While the core business of a SaaS start-up revolves around groundbreaking technology and a dynamic product, it is crucial not to overlook the significance of a forward-looking finance department. Often underestimated, the finance team plays a pivotal role in the growth and sustainability of a SaaS start-up. In this comprehensive article, we delve into the multifaceted importance of a forward-looking finance department and explore how it drives success in the thriving world of SaaS ventures.

Financial Planning and Budgeting: Guiding the Path to Success

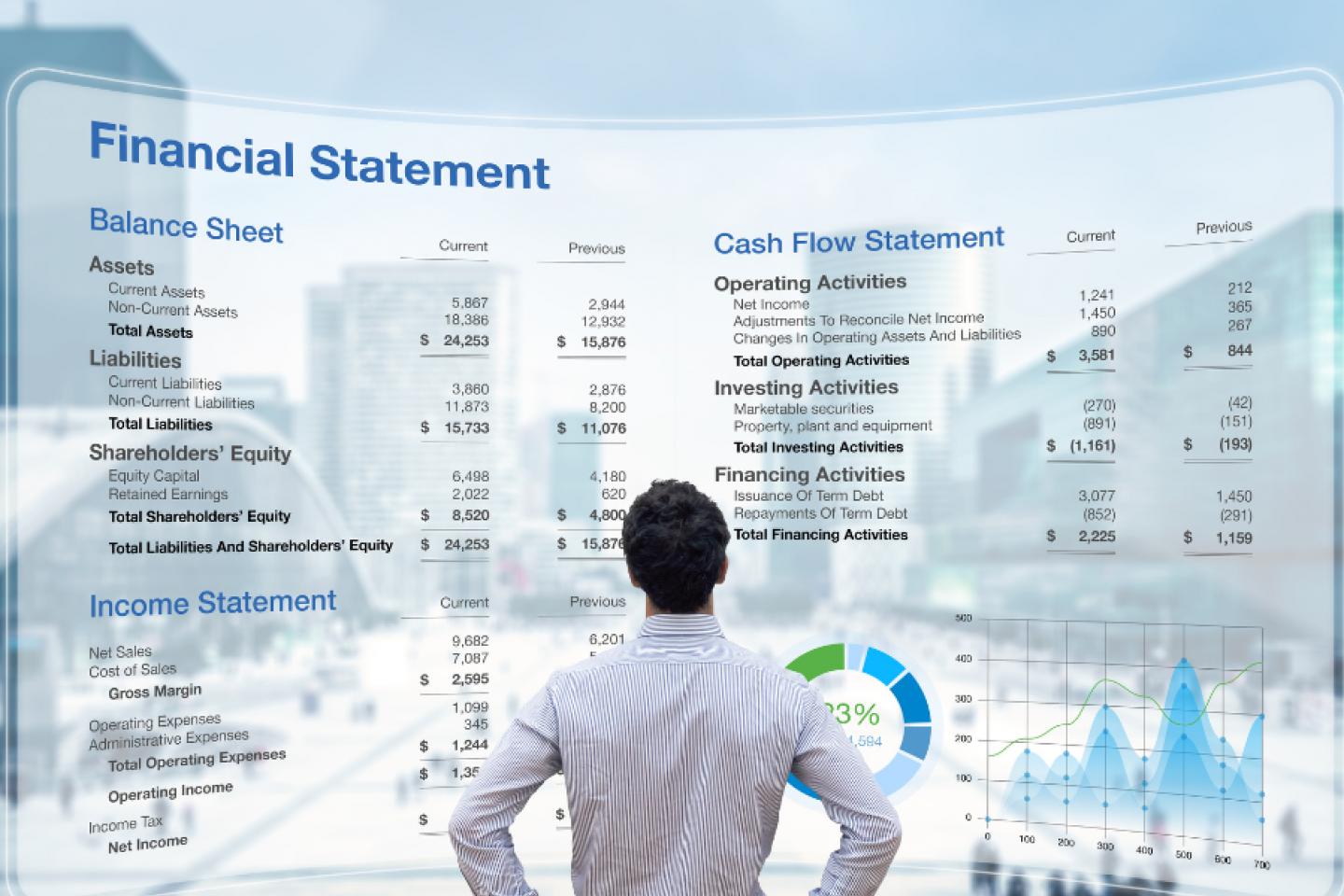

In the rapidly evolving world of SaaS, the ability to make informed and strategic financial decisions can be a significant determinant of success. A forward-looking finance department is instrumental in evaluating the current financial performance of the start-up, anticipating future trends, and crafting comprehensive budgets to align with the company's objectives. By forecasting expenses, revenues, and cash flows, the finance team ensures that the financial trajectory is aligned with the company's growth targets and strategic vision. Furthermore, this proactive approach enables SaaS start-ups to allocate resources optimally, fostering efficiency and long-term sustainability.

Strategic Decision-Making: Navigating the Turbulent Waters

The SaaS industry is marked by fierce competition, evolving customer demands, and dynamic market trends. In such a landscape, the decisions made today can have far-reaching consequences for the company's future. A forward-looking finance department provides valuable insights and data-driven analyses that empower the management to make informed strategic choices. Whether it's expanding to new markets, investing in research and development, or acquiring complementary businesses, the finance team aids in evaluating the potential risks and rewards, fostering a more successful and sustainable path. Their financial acumen enables the leadership to strike the right balance between growth, innovation, and risk management.

Capital Management and Fundraising: Fuelling the Journey

Capital is the lifeblood of any start-up, and prudent capital management is vital for long-term viability. A forward-looking finance team helps in optimizing capital structure, managing cash reserves, and minimizing financial risk. By maintaining a healthy balance between equity and debt, a SaaS start-up can secure its financial position and attract potential investors. The finance department plays a crucial role in fundraising efforts, where their well-prepared financial reports and projections enhance the start-up's credibility and increase its chances of securing funding. A strong finance team provides investors with the confidence that their investment will be managed efficiently, and that the start-up has a clear financial plan for growth.

Customer and Market Insights: Nurturing Customer-Centricity

In the world of SaaS, understanding customer behaviours and market trends is paramount. A forward-looking finance department is not just focused on numbers; it also plays an active role in analysing subscription data, customer acquisition costs, and customer lifetime value. By diving deep into this data, finance professionals can provide valuable insights into customer preferences and market demands. This data-driven approach enables SaaS start-ups to tailor their product offerings, marketing strategies, and pricing models to meet customer expectations effectively. The finance department's collaboration with other teams, such as sales and marketing, fosters a customer-centric culture that drives innovation and ensures a seamless customer experience.

Monitoring Key Performance Indicators (KPIs): Keeping the Pulse

In the fast-paced SaaS ecosystem, constant monitoring of performance metrics is crucial. The finance department tracks essential KPIs like customer churn rate, customer acquisition cost (CAC), monthly recurring revenue (MRR), and customer lifetime value (CLV). These metrics provide the management team with real-time feedback on the effectiveness of their strategies and help identify areas for improvement. By staying vigilant about performance indicators, the finance department contributes to a data-driven decision-making culture, enabling the organization to respond swiftly to emerging opportunities and challenges.

Compliance and Risk Management: Safeguarding the Future

In the highly regulated business environment, compliance is non-negotiable. A forward-looking finance department ensures that the start-up complies with all financial and regulatory requirements, safeguarding the company's reputation and avoiding costly penalties. Moreover, the finance team is responsible for identifying and managing financial risks. By conducting risk assessments and implementing risk mitigation strategies, they protect the company from potential financial downturns and unforeseen challenges. A strong risk management framework instils confidence in stakeholders, promoting investor trust and attracting potential partnerships.

In the dynamic landscape of SaaS start-ups, where innovation and adaptability are the cornerstones of success, a forward-looking finance department proves to be an indispensable asset. By proactively planning, analysing, and guiding strategic decisions, the finance team provides the necessary financial foundation for sustainable growth and profitability. Their ability to interpret financial data, customer insights, and market trends empowers the company to stay agile and responsive in an ever-changing industry. As SaaS start-ups continue to disrupt traditional business models, embracing the value of a forward-looking finance department becomes even more critical for thriving in the digital age. By nurturing financial foresight, strategic decision-making, and customer-centricity, the finance department emerges as a vital catalyst in propelling SaaS start-ups toward a brighter future.

If your company lies within the Tech or SaaS space and you’re keen to build out your finance team, don’t hesitate to get in touch with Thomas ([email protected]) for expert support.

When we work in harmony, great things happen. Let’s show you how.

Get the latest insights, tips, and opportunities straight to your inbox – sign up today!