Which SaaS metrics should you be measuring and Why? Our resident SaaS expert @Chris Short shares his thoughts

The FinTech industry has earned a reputation for delivering constant innovation, cutting-edge technology, and groundbreaking products - and that isn’t going to change in 2023.

5 Exciting FinTech Trends To Watch In 2023

The FinTech industry has earned a reputation for delivering constant innovation, cutting-edge technology, and groundbreaking products - and that isn’t going to change in 2023.

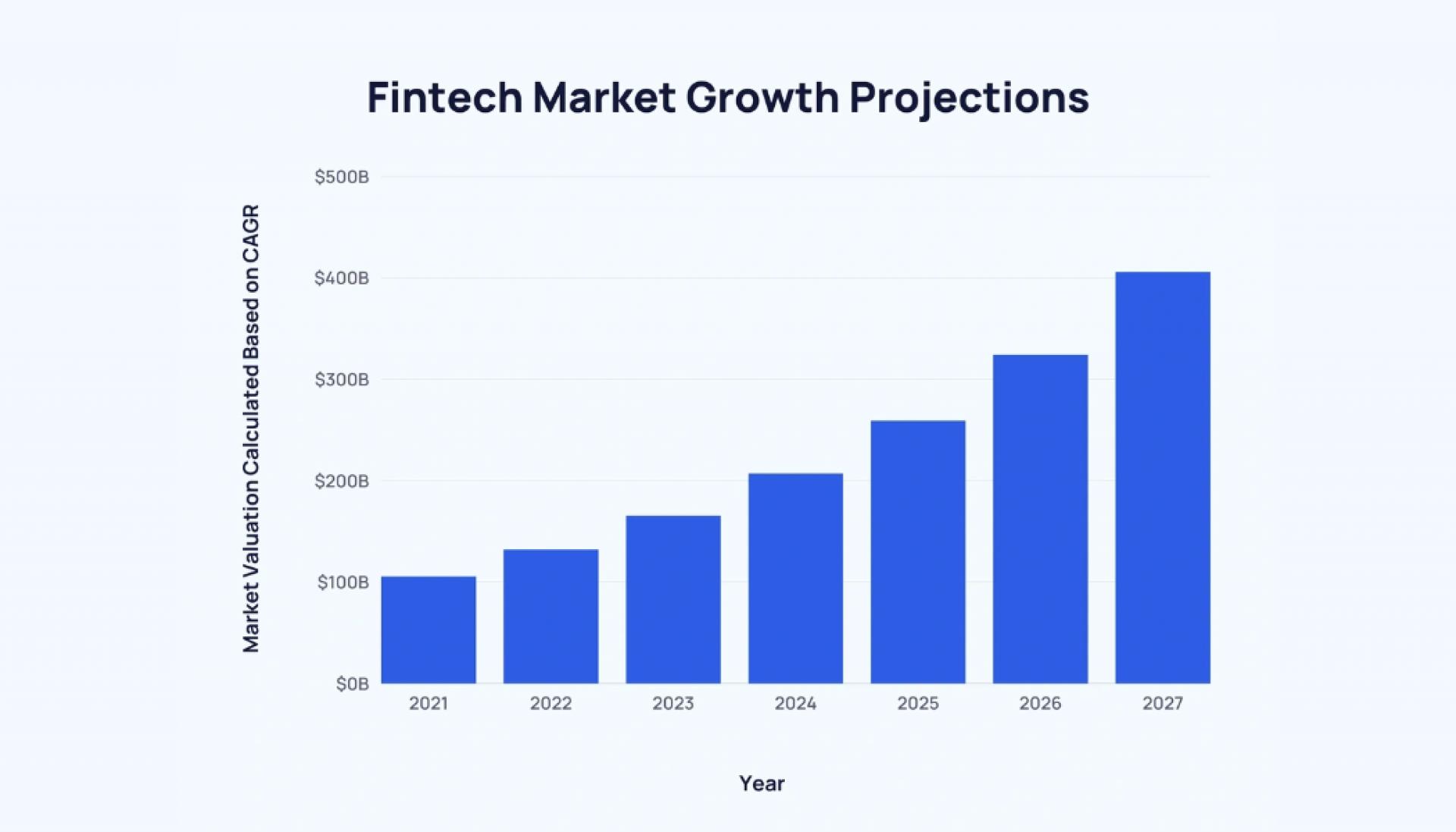

It’s estimated that the value of the FinTech sector will reach $174bn this year, which isn’t surprising when you consider how many FinTech solutions are now present in our daily lives.

Every area of personal and business finance has been transformed by FinTech innovations, from banking to card payments and loans. This progress won’t be slowing down, either - FinTech brands are constantly looking to adapt, predicting consumer needs to develop new products and technologies.

So, if the FinTech industry continues to innovate at light speed, what can we expect from the sector this year? How might our lives be impacted by new products and services?

Let’s take a look at 5 exciting trends that will shape the development of the FinTech space in 2023.

1. Embedded finance will continue to explode in popularity

Embedded finance describes a category of financial products that can be accessed within a specific framework or platform. In simple terms, these are financial services that customers can use without switching between multiple apps or websites.

It’s all about convenience and accessibility for consumers.

For example, many e-commerce platforms now offer ‘buy now, pay later’ (BNPL) options at the checkout. But if you’re keen to take advantage of BNPL, you don’t need to visit your local bank or fill in extensive paperwork - you can instantly access credit on the website you’re using.

Another example is embedded payments. Customers don’t need to constantly re-enter their credit card details every time they make a purchase, because the information is already stored - or in other words, embedded - online.

Industry experts predict that the market for embedded financial services will expand by 40.4% annually over the next few years, and it’s easy to see why. Embedded finance makes everything from ordering shopping to buying insurance infinitely easier, which is great news for both businesses and consumers.

2. RegTech will become increasingly important in the finance world

RegTech leverages cloud technology and artificial intelligence to identify and prevent risks, streamline regulatory processes, and ensure financial compliance. This has proven to be agame-changer for financial institutions around the world.

Financial businesses often handle mind-blowing quantities of data, which can lead to several complications. For one thing, this data usually needs to be processed and categorized - but this would be an impossible task to complete manually. Secondly, there are a huge number of laws and regulations that companies need to follow for data handling, but it can be difficult to keep up with the latest updates.

This is where RegTech can make a difference.

RegTech solutions can significantly improve the efficiency and accuracy of data management, helping financial institutions to avoid compliance issues and maximise performance.

More than 30% of financial companies spend over 5% of their revenue on compliance - which explains why the RegTech industry is predicted to experience 200% growth between 2022 and 2026.

Businesses like JP Morgan have incurred heavy penalties ($125m in 2021) for compliance errors, which proves the value of RegTech innovations. Start-ups such as Ascent have helped banks reduce the length of regulatory processes from thousands of hours to a matter of minutes, and the appetite for RegTech is only going to increase this year.

3. Blockchain will remain an integral part of the FinTech industry

Blockchain has been a staple of global FinTech conversations for a number of years, but the industry is set to continue growing in 2023.

Blockchain is essentially a digital ledger that records, verifies, and facilitates various types of transactions. A major selling point here is security and autonomy, since businesses and individuals can transfer digital assets without relying on a central authority or financial institution.

However, it’s not just the self-governance of blockchain that appeals to users.

Blockchain can also be highly effective at reducing transactional costs since there’s no need for expensive intermediaries such as banks and brokers. On top of this, since all blockchain transactions are stored on a public ledger, there’s also increased transparency between parties, which is key for building trust.

As blockchain eliminates the need for traditional bank accounts, it’s also making it far easier for all individuals to utilise financial products. This is particularly important in developing countries, where accessing banking services can be extremely challenging.

The potential applications for blockchain are almost limitless, and the sector will undoubtedly produce some exciting new ideas and concepts in 2023.

4. The banking sector will continue to embrace artificial intelligence

Artificial intelligence is continuing to transform various global industries, and the banking sector is no exception.

Everything from customer service chatbots to fraud detection systems are now being powered by artificial intelligence, and the relationship between financial brands and AI platforms is only getting stronger.

Research company Autonomous NEXT predicts that AI will reduce operating costs in the finance industry by 22% in the next 7 years - that equates to around $1 trillion in savings. With those kinds of numbers being thrown around, it’s clear to see why so many financial institutions are embracing machine learning.

Three key opportunities for AI have been identified in the banking field - customer engagement, fraud detection, and underwriting.

Innovators like Socure (a Nevada-based company) are already utilising AI for digital identity verification and fraud prevention, while Gila (a customer service platform used by 250+ banks) is leveraging AI to enhance customer service communications.

5. FinTechs will strive to achieve sustainability alongside financial innovation

Consumers are beginning to become more aware of the climate emergency, preferring to spend their money with brands that are eco-conscious and environmentally friendly.

FinTech providers are recognising this trend and reacting accordingly.

The Boston Consulting Group estimates that the ‘sustainable finance’ market will be worth more than $30 trillion in a matter of years, as environmental concerns and business priorities overlap. This will impact everything from socially-responsible investing to asset management, and FinTechs with a genuine interest in eco-friendly business practices will be able to capitalise on a massive opportunity.

This market shift has seen the emergence of collectives like the Sustainable Fintech Fund, which aims to ‘create a modern, sustainable financial industry’.

Many green FinTechs are also experiencing huge success in the consumer market. Apps like Joro help users to understand their personal carbon footprint and make purchases that are better for the environment.

The future of the FinTech industry has never been brighter.

Technology such as blockchain and embedded finance is continuing to enhance our everyday lives, RegTech is drastically improving efficiency for financial institutions, and FinTechs are making huge strides towards sustainability.

However, we’ve only scratched the surface when it comes to the true potential of financial technology.

As future-facing FinTech companies continue to push for innovation, we’ll inevitably see new solutions emerge that offer benefits we haven’t even considered. FinTech is one of the most inventive sectors on the planet, and 2023 is set to be one of its most exciting years yet.

If you’re looking for guidance on finding the best talent for a growing finance team within Fintech, please get in touch with [email protected].

When we work in harmony, great things happen. Let’s show you how.

Get the latest insights, tips, and opportunities straight to your inbox – sign up today!